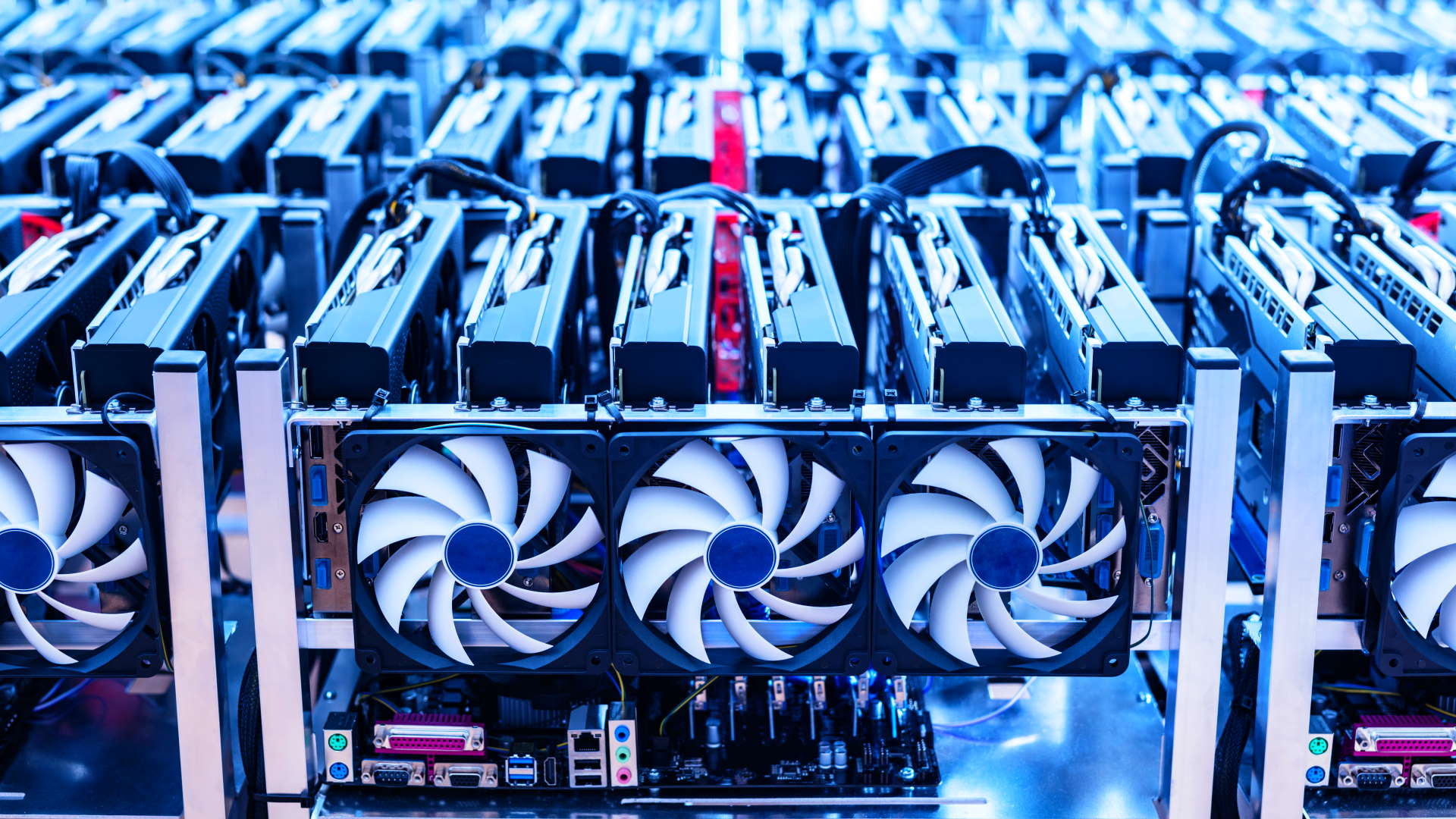

A mined GPU will lose an estimated 10% of its original performance each year. That is the word from graphics card manufacturer, Palit Microsystems. Company representatives have spoken to Benchmark.pl , and are keen to warn gamers against the lure of cheap second-hand GPUs previously used for cryptocurrency mining.

There is a current influx of more affordable modern graphics cards , primarily in Asia, as a recent crackdown in China has shut down many outfits in different parts of the country. That has pushed some mining operations overseas instead, with the US now accounting for over a third of the world’s Ethereum nodes , and China now sitting below Germany in the table with less than a 10% share.

Newly shut down operations are trying to recoup some of their losses by capitalising on the still intense demand for graphics cards from everyday PC gamers. These used, and often abused, cards are then pushed out into the second-hand market, with a tempting price tag, and every attempt made to hide their mining origins.

But should you actually be tempted? If there is a second worldwide crypto crash and it becomes unprofitable to mine Ethereum at all, then we’ll see the second-hand GPU market across the globe flooded with all the cards we’ve been desperate to get our hands on for the last year or so. Then it stops being a theoretical question and something a lot of us are going to have to think long and hard about.

With the potential for these GPUs to have crawled out of the cryptocurrency mines, the second-hand graphics card then becomes more of a lottery than usual. It’s incredibly hard to be able to tell from a simple listing whether the GPU in question has been used for mining.

Unless there’s some form of non-standard cooler attached to it, that is.

That should be a major red flag. If a card has had its stock cooler replaced there is a greater than normal chance that’s because the GPU has had an issue in the past, and it may also indicate that other modifications may have been made to the board. Any changes to the graphics card itself will mean any potential warranty is immediately voided.

Still, some modded cards can still have their original coolers strapped back on, and may even have some seemingly original packaging too, and from a simple second hand listing you’d be hard pushed to tell the difference.

On the flip side, there are some careful miners out there who will studiously undervolt their GPUs, which can improve sustained clock speeds, efficiency, and therefore provide better hash rates. Such second-hand cards may actually come out of the mines relatively intact, though there is no way to know if that is indeed the situation a particular GPU has found itself in.

Palit reps point to independent tests carried out on mining cards, which suggest that you can expect a 10% degradation in GPU performance for each year of service in a 24/7 cryptocurrency operation. Which seems like a pretty good yardstick to use when considering your options in the second-hand market; even if a given card actually works when you get hold of it, there’s a good chance it won’t be operating at its peak.

Inevitably Palit—a graphics card manufacturer which gains nothing from the second-hand sale of GPUs—has a vested interest in making sure you buy your graphics cards new. But these are still important things to remember when that tantalising Ebay listing suddenly pops up for a ‘nearly new RTX 3070’ without a ludicrous mark up.

Sure, you could get lucky and your used GPU will be lovingly cared for miner, one which will give you many long years of gaming service, happy not to be just number crunching day-in-day-out.

Or you could end up with a brick that breaks down after a few days playing CS:GO. Yeah, as I said, a lottery. And a potentially expensive one if you’re not lucky.